You’ve just obtained a raise. You’re excited!

What’s the first thing you think of doing with this new found income? Is your inclination to up your 401k contribution percentage? How about open up a Roth IRA? Perhaps your mind starts thinking of that new car or outfit instead.

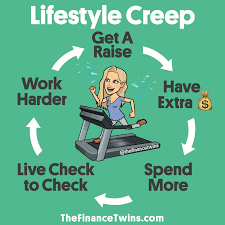

This post isn’t intended to crush everyones fun when it comes to upgrading their lifestyle and buying fancier things. What it is meant to do however is point out some of the pitfalls I’ve noticed over the years when households allow this thing into their life…the dreaded lifestyle creep.

This concept is highlighted in this wild ride of a year we call 2020. People around the world have been affected in a variety of ways, and losses in income are certainly one of those impacts. These changes tend to occur suddenly and sharply, very similar to how the stock market reacts. The analogy often provided is taking the escalator up and then the elevator down.

It’s similar with lifestyle creep in that over time household income may gradually increase, but then we as human beings have this desire to live up to our means. We get that bigger and nicer house…upgrade to the higher trim level on a new car…buy the fanciest stroller for our baby.

All of these decisions build on top of each other, and when an unexpected turn of events causes a substantial loss of income or principal, we don’t have the time to pick up the pieces and weather the storm properly. You may be left taking on extra debt or having to liquidate assets you’d prefer not.

Peace of mind is a wonderful thing. Building a strong foundation of cash reserves and identifying as someone that lives below their means will do wonders for your level of contentment. Should a seismic shift occur and the earth starts rattling beneath your feet, you can rest easy knowing that you’ve built something to last.

It’s so easy in this day and age to look on social media and find yourself wishing you had this or that thing. Impressed by someone else’s fortune and longing to have it as quickly as possible so that you might be able to impress someone else.

What’s even more satisfying than purchasing that next thing however is having control of your time and being able to maintain your current lifestyle when everything around you is crumbling. If you’ve set yourself up and continually lived below your means while maintaining proper savings, you don’t have to make major sacrifices suddenly.

There is nothing worse than having to downgrade and retreat financially because you weren’t properly prepared. Instead, take pride in knowing you’ve rejected that lifestyle creep. Forego unnecessary or frivolous debt, build out that 3-6 month cash reserve and take comfort in what you have right now in front of you.